Sector Overview: S&P 500 Systems Software

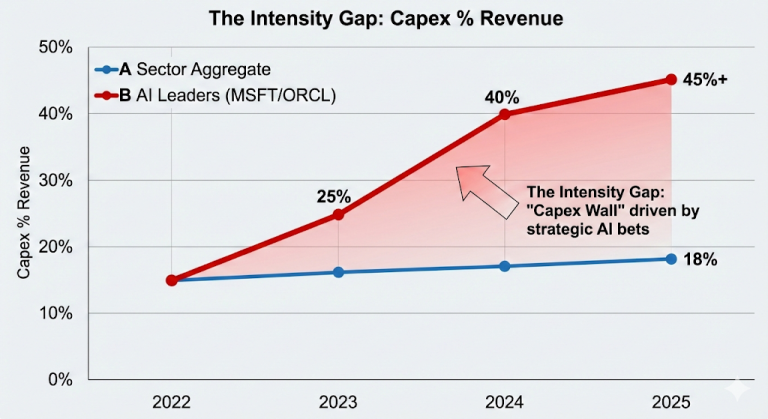

Section 1: Introduction and Industry Definition The Systems Software sub-industry represents the foundational infrastructure layer of the global digital economy. Within the Global Industry Classification Standard (GICS) framework, this sector is distinct from Application Software; whereas application vendors provide tools for end-user productivity (e.g., creating a spreadsheet or managing a sales pipeline), Systems Software companies…